Saudi Arabia’s Public Investment Fund (PIF) invested in two Canadian energy companies in the first quarter of 2020, expanding its holdings in the sector likely at lower-than-usual valuations as oil prices hit cyclical lows this year.

Yassir Al-Rumayyan is Chairman of the PIF.

According to a report in the Financial Post, an online Canadian news source, filings with U.S. Securities and Exchange Commission “indicate the kingdom’s Public Investment Fund, which has an estimated US$320 billion in assets under management, bought stakes worth US$481 million and US$408 million in Suncor and Canadian Natural Resources, respectively, some time during the first quarter of 2020.”

The PIF’s stake in Calgary-based Canadian Natural Resources Ltd. amounts to 2.6% of the company, and its stake in Suncor is 2%. According to Bloomberg, the PIF is now the eighth largest shareholder in Canadian Natural and 14th largest in Suncor.

It is not known precisely when the stakes where secured by the PIF.

When taken alongside the PIF’s investments in other energy companies, inclding Equinor ASA, Royal Dutch Shell Plc, Total SA and Eni SpA, along with the purchase of other stocks this year, it is clear the PIF has taken a strategic investment pivot toward investing in established companies at lower valuations that are likely to bounce back over time. Until this year, many of the PIF’s investments were seen as stakes taken in chic, booming businesses with high valuations. The PIF’s stake in Uber Technologies Inc. is one such investment.

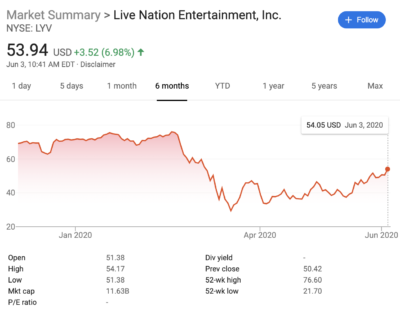

LiveNation’s stock price this year.

Take, for example, the PIF’s recent acquisition of a 5.7% passive stake in Live Nation Entertainment Inc., announced in April during the height of the Coronavirus shutdown that has cancelled many concerts and events. Live Nation is an entertainment company that promotes events including ticketing, sponsorship and advertising services.

According to Reuters, the company warned of a hit to its business earlier in April as a result of postponement or cancellation of shows due to the coronavirus pandemic. Then, the PIF swooped in, betting that eventually, business would return to normal.

If the PIF took a stake in LiveNation on April 27th, the first public report of its acquisition, it would have done so at a stock price of about $42. Today, the stock is trading above $54, which means the PIF would have already seen a 28% increase in its investment in LiveNation since April.

The PIF also made a similar investment in Carnival Cruise Lines. The PIF disclosed an 8.2% stake in coronavirus-hit Carnival Corp, sending the cruise operator’s shares nearly 30% higher at the time. The PIF acquired 43.5 million shares of the vacation company, betting on a rebound in business after the Coronavirus pandemic fades.