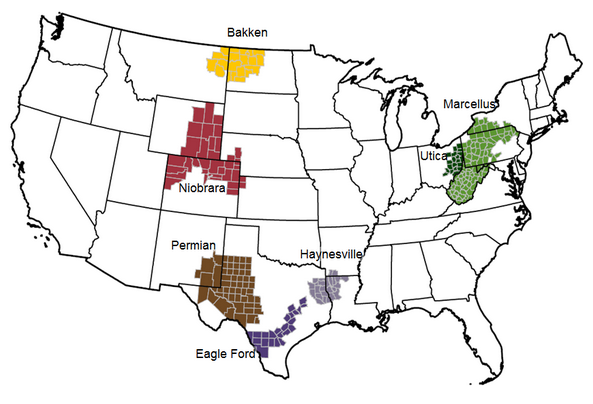

The second half of 2014 has been a lively period for the U.S. shale industry.

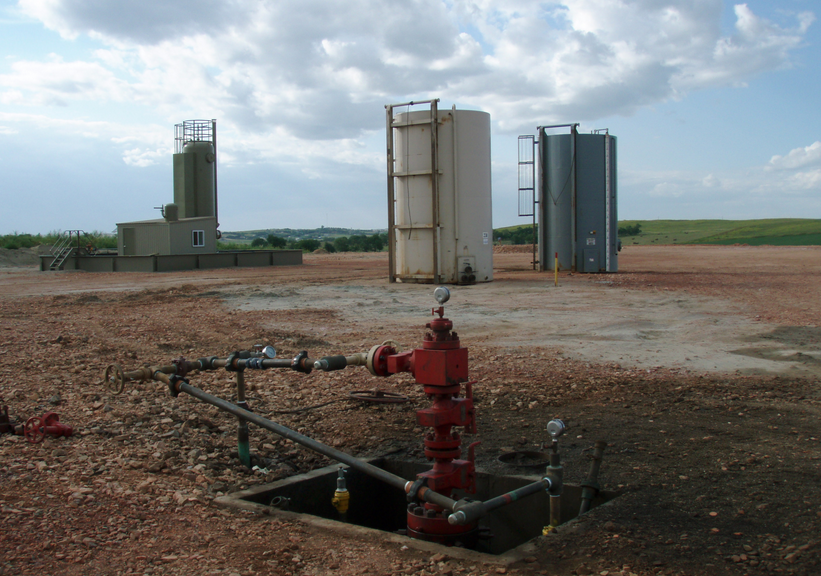

Fueled by new technologies and a soaring oil price, everyone from upstart producers to big oil were taking advantage of new production opportunities in United States in shale deposits. Over the last year, the U.S. alone accounted for 82% of non-OPEC production growth, and overall American oil production surpassed that of every OPEC producer save Saudi Arabia. Oil production in the United States is at a 31-year high, at roughly 8.7 million barrels, and imports at the lowest level since 1995, Bloomberg reports.

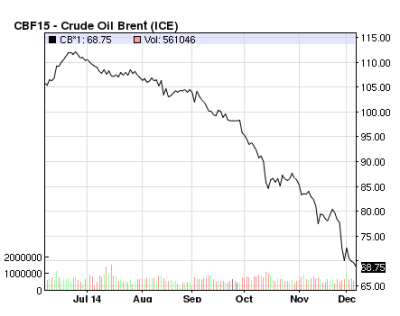

However, as the price of oil falls below $70 – roughly 40% since July – the tight oil sector in American is facing a significant challenge. Margins for tight oil producers in the United States are much smaller than other producers like Saudi Arabia’s Aramco. And, with a 39-year-old U.S. ban on exports of oil, small producers in the United States are feeling the squeeze.

Oil’s price since July 2014

Last month, new permits for drilling in Texas were down by 50% from the previous month, according to a report in FuelFix, “a sign that oil companies are holding back from boring into their sweetest spots while crude prices linger below $70 a barrel.” It was the first time in a year that new permits dropped.

In the United States, analysts and others are pointing fingers at OPEC and specifically Saudi Arabia for the Kingdom’s role in dropping prices.

“This is the second salvo in the OPEC price war, a new offensive by the Saudis,” said Phil Flynn, analyst at the Price Futures Group in Chicago, according to Reuters.

But Meghan O’Sullivan, writing in Bloomberg news as syndicated in the Chicago Tribune, says that an uncertain bottom is not ideal for Saudi Arabia, and that Saudi Arabia’s squeeze on American producers is “over-emphasized” by analysts.

“Some analysts, I believe, over- emphasize the Saudi desire to challenge U.S. shale production — particularly given that increased American oil production over the past few years has eased what would have been enormous pressure on Saudi Arabia to bolster its own production capacity, at great cost.”

Oil price stability and steady markets are desirable for the Kingdom of Saudi Arabia, which is interested in a predictable price because it must plan its government budget – heavily dependent on oil revenues – on a certain price ahead of time. The government budget is being finalized now and is typically released before the start of the new year on the Gregorian calendar.

In a recently released note by Jadwa Investment, a Riyadh-based firm, Head of Research Fahad Alturki wrote that “OPEC’s decision not to cut output adds further uncertainty not only on the global oil market and the outlook for oil prices, but also on the outlook for the Kingdom’s fiscal policy.” Alturki wrote that while variables in the market would affect prices over the next two years, “prices of $85 and $83 per barrel for 2015 and 2016, respectively, are most likely.”

“These lower prices will have a direct impact on the balance of payments and fiscal position of the Kingdom,” Alturki said.

“The contest between the shalemen and the sheikhs has tipped the world from a shortage of oil to a surplus,” writes the Economist. Although sluggish growth in the global economy and oversupply is to blame for fall in oil prices, “cheaper oil should act like a shot of adrenalin to global growth. A $40 price cut shifts some $1.3 trillion from producers to consumers. The typical American motorist, who spent $3,000 in 2013 at the pumps, might be $800 a year better off—equivalent to a 2% pay rise.”

Regardless of OPEC intent, the oil output trend will still be upward in the U.S. shale patch despite a decline in price writes Ben Geman in the National Journal. “One reason is that producers can squeeze cost savings from projects….But make no mistake: The shale patch is at war in the new price market.”

Shale producers in the United States are now turning to their own government for help by repealing the ban on exports. “Removing the ban could erase an imbalance between U.S. and foreign crude prices by expanding the market for shale oil,” according to Bloomberg, which notes that lawmakers in Washington are set to hold a hearing next week on removing the ban.