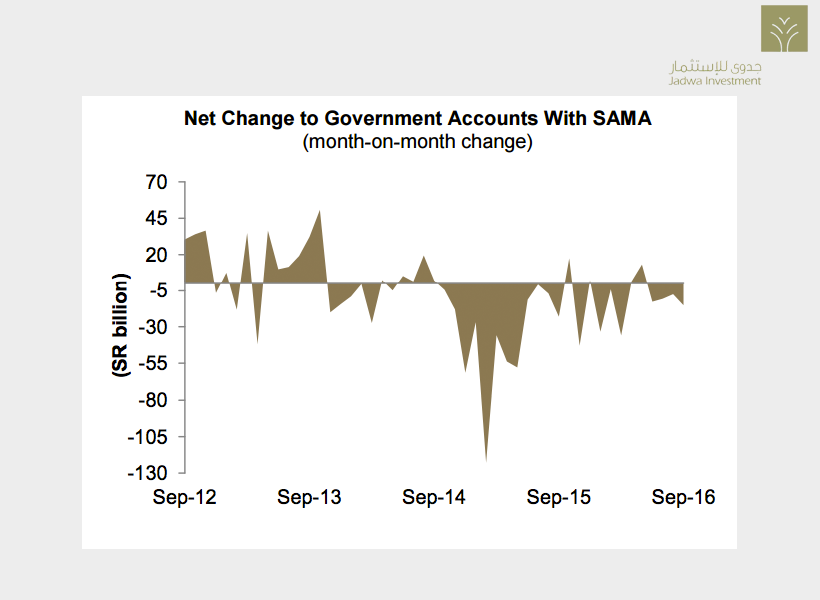

Jadwa Investment’s recently released economic chartbook for the month of November found a downward trend in economic activity and the fourth consecutive negative change in government accounts with SAMA.

“Economic data for September showed a downward trend in economic activity,” Jadwa said it the report, pointing to negative growth in cash withdrawals from ATMs and point-of-sale transactions in both year-on-year and monthly terms. The non-oil PMI slowed, but continued to point to an expansion in activity, and cement sales and production suggest weaker activity, Jadwa notes.

More from the report:

-The net monthly change in government accounts with SAMA remained negative for the fourth consecutive month, falling by SR15 billion in September.

-Measures to manage liquidity have contributed to halting the constant rise in the cost of funding. Moving forward, we expect an increase in government deposits to result in a further easing of liquidity conditions.

-Inflation slowed to 3 percent in September, a new 2016 low. We believe that easing liquidity conditions will prevent inflation from slowing further during the remainder of 2016.

-August data on non-oil exports and imports showed a recovery from four and five-year lows, respectively. However, despite August’s recovery, both remained consistently lower than previous years.

-Brent oil prices hit highs of $51 per barrel (pb) at one point in October, but dipped towards the end of the month, as doubts begin to build as to whether OPEC can reach an agreement.

-Whilst the US Dollar is expected to continue strengthening in the months ahead, its rise could be interrupted by an unexpected outcome in the US elections in early November.

-The combination of a record international bond sale by the Kingdom and higher oil prices led to TASI rising by 10 percent during October.