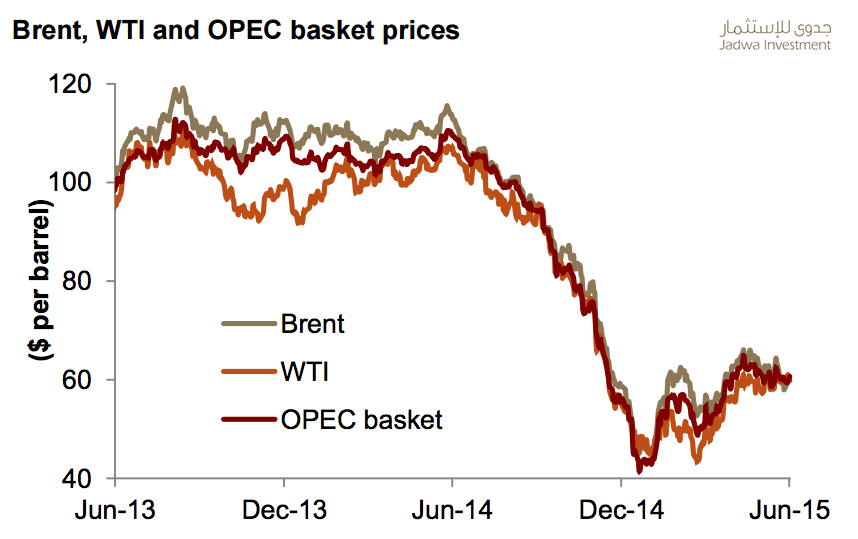

Oil prices are rebounding steadily following a low point at the beginning of 2015, according to a recently released analysis of the oil market by Riyadh-based Jadwa Investment.

Jadwa Chief Economist Dr. Fahad Alturki said that a general improvement in oil demand and slowdown in the rate of growth in US shale oil output combined to push prices up 13 percent, quarter-on-quarter, in Q2 2015. “US oil production is estimated to have fallen by 4 percent, in Q2 2015, year-on-year. Increases from OPEC and non-OPEC sources, however, will ensure that global oil balances remain in surplus throughout 2015. As a result we see full year Brent crude oil averaging $61 per barrel.”

“Domestically, Saudi crude consumption will reach 3mbpd in Q3 2015, as domestic demand peaks due to the summer months. In the last three years, quarter-on-quarter growth in Q3 has averaged 250 thousand barrels per day, and we expect to see a similar quarterly rise in total crude consumption this year as well,” Alturki said.