Jadwa Investment’s Saudi Chartbook for the month of December 2012 assesses a number of key aspects of the Saudi economy including the real economy, bank lending, banking indicators, inflation, trade, oil, exchange rates, the TASI (Saudi Stock Market), sectoral performance, and more. A summary of the report is provided for your consideration below, and the entire report can be read by clicking here.

***

Real economy: Economic data for October stayed healthy. Indicators of consumer spending increased in nominal term while year-on-year comparisons slowed due to a larger base effect. Cement sales is slightly rising from the summer slow activities.

Monetary indicators: Broad money supply (M3) monthly growth accelerated in October to a 19-month high on the back of rising currency outside banks as well as demand deposits. The former followed a regular upward trend during the Hajj and holiday season.

Bank lending: Bank credit to the private sector continued to expand at a healthy rate in October. A notable trend is the strong expansion in medium-term credit which reflects the banks participation in financing infrastructure and housing projects.

Bank liquidity indicators: Banks liquidity profile remained strong with deposits rising for the third consecutive month in October. The loan-to-deposit ratio slightly declined. Bank excess deposits at SAMA remained high, giving scope for further lending growth.

Inflation: Year-on-year inflation slightly increased in October, though this hid some sharp movements, with rental and educational inflation easing and food and home furniture inflation rising. Inflation in Saudi Arabia was the highest compared to other GCC countries.

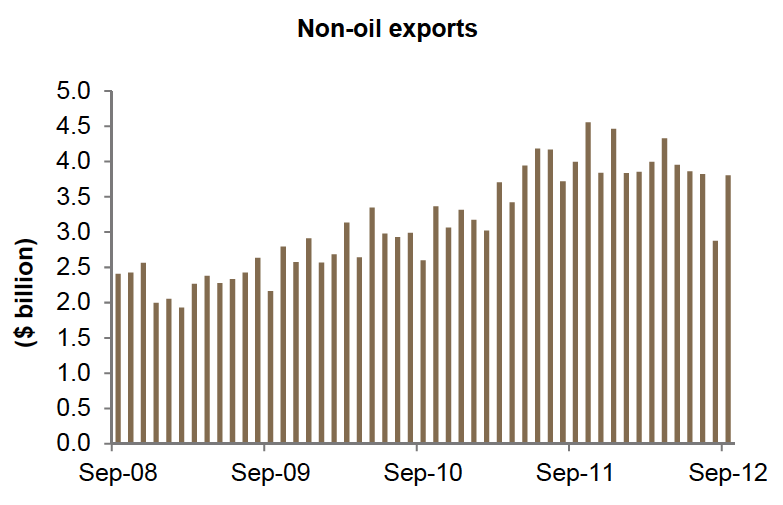

Trade: Non-oil exports recovered from a two-year low owing to greater exports of petrochemicals and plastics. Imports also jumped to close to an all-time high in September and data on letters of credit issued for imports suggest imports are likely to remain at this level.

Oil: Oil prices moved within a tight range in October with monthly average below the previous month. The decline is mainly due to global macroeconomic concerns while geopolitical risk maintained a somewhat stable price-floor above $100.

Exchange rates: The euro strengthened against the dollar over in November owing to concerns about US fiscal cliff, yet the gloomy economic outlook for the euro zone is likely to limit such trend. Expectations of aggressive monetary policy weighed on the Yen.

Stock market: The TASI fell in November, the third consecutive monthly drop. The decline was driven by sentimental impact of rising regional geopolitical risks. Deepening problems in the euro zone and the looming US fiscal cliff has also played a role.

Sectoral performance: All fifteen sector registered negative growth in November. Cement and transportation are relatively the best performers.