The latest edition of the monthly chartbook from Jadwa Investment found some encouraging data points on the Saudi economy, as observers of the Kingdom look for a strong year of growth in 2022.

The Saudi stock market performed well in February despite the Russian invasion into Ukraine. TASI continued trending higher in February, rising 2.6 percent month-on-month, as investors seemed unfazed by the turmoil.

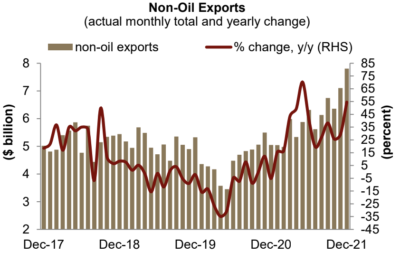

Latest available data showed non-oil exports rising in December to a new monthly record high. For full year 2021, non-oil exports also reached all-time record highs of $73.3 billion, up 35 percent over 2020 totals.

The non-oil PMI declined slightly further in January, affected by lower new orders and business activity. Also during the month, cement sales and production continued to trend downwards by 4.6 and 6.5 percent year-on-year, respectively. Meanwhile, latest available full year 2021 data showed non-oil exports reached all-time record highs of $73.3 billion, up 35 percent over last year’s total, according to Jadwa.

Consumer spending was up 8.4 percent year-on-year in January, and by 0.2 percent month-on-month. Within this, POS transactions rose by 17 percent, whilst cash withdrawals were down by 4.3 percent year-on-year.

In December, the non-oil manufacturing index rose by 9.7 percent year-on-year. The monthly value of licensed investments in new factories increased to SR3.2 billion, with 80 new licensed factories during the month. December also saw a notable increase in the number of total workers spurred by a rise in both foreign and Saudi workers, according to the data.

The net monthly change to government accounts with SAMA declined by SR5.7 billion in January. Meanwhile, domestic bank holdings of government bonds declined in January by SR15.6 billion. SAMA FX reserves declined in January by $8.6 billion month-on-month, to stand at almost $447 billion. We expect SAMA FX reserves to total $509 billion by year end.

On inflation, prices in January rose by 1.2 percent year-on-year, and by 0.2 percent month-on-month. Within the CPI basket, ‘food and beverages’ rose by 2 percent year-on-year, and by 0.4 percent month-on-month, according to Jadwa Investment.

[Click here to read the full report from Jadwa Investment] [Arabic]