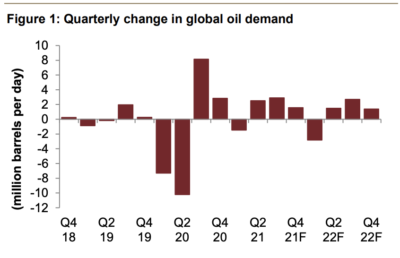

Global demand for oil is soaring in 2021 as the world rebounds from the pandemic year, according to OPEC data and shared by Riyadh-based Jadwa Investment in an oil market update.

According to OPEC data, Q2 2021 oil demand rose by 3 percent quarter-on-quarter and a sizable 14 percent year-on-year. The outlook for the remainder of the year is consistent with previous estimates, with oil demand expected to keep growing quarter-on-quarter in Q3 and Q4 2021, Jadwa writes. Overall, only transportation fuels (jet fuel and gasoline) are showing sizable differences in demand when compared to pre-pandemic levels.

Oil demand has risen 14 percent (or 12 mbpd) on a year-on-year basis in 2021.

According to the report, OPEC expects oil demand to climb by 3 percent on a year-on-year basis in full year 2022, to a total of 99.9 million barrels per day (mbpd), similar to levels seen before the Pandemic in 2019.

On the supply side, the so OPEC+ group of countries “continued exhibiting strong levels of compliance during Q2 2021, with (over) compliance averaging 113 percent,” Jadwa notes.

That level of compliance appeared to be in jeopardy in recent weeks as Saudi Arabia and the UAE appeared to be at odds over production quotas. However, both nations have reportedly reached a compromise over OPEC+ policy, according to Reuters on Wednesday which cited an unnamed OPEC+ source. The deal, if made official, would supply more crude to a tight oil market and provide downward pressure on increasing prices.

As demand continues to rebound and grow, the OPEC+ group will need to produce more to balance the oil market in the coming months. “But there’s less unanimity on just how much more crude they will have to pump,” Bloomberg’s Julian Lee writes.

“The International Energy Agency, the U.S. Energy Information Administration and the Organization of Petroleum Exporting Countries all say that global oil demand will continue to recover through to at least the end of next year. By that point, all three see consumption exceeding comparable 2019 levels and hitting new highs. But there is still some disagreement on the paths it will take to get there,” Lee writes.

[Click here to read the full oil market report from Jadwa Investment] [Arabic]