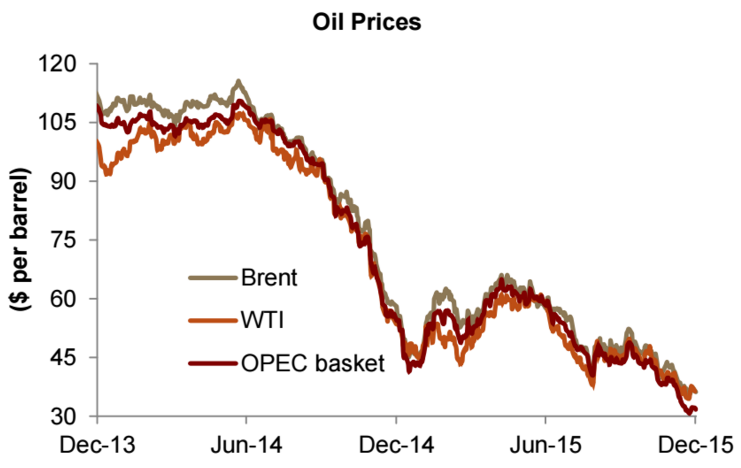

The price of oil on Brent fell below $30 a barrel for the first time since April 2004, but eventually recovered to $30.22, according to reports.

Oil prices have fallen by 70% in the past 15 months.

A gusher of supply from around the world continues to put downward pressure on prices. According to CNBC, U.S. government data show no slowdown in American production — at 9.23 million barrels a day last week, up slightly from 9.22 million barrels the week earlier. U.S. gasoline and diesel supply is weighing on already weak oil prices.

Daniel Yergin, Pulitzer Prize-winning author and energy market analyst, told CNBC that a fall to $10 a barrel was not out of the question, though the last time the price of oil fell to those levels was in 1998 and 1986 when supply outpaced storage capacity.

A great near-term uncertainty for oil markets begins on Friday or Monday, when Iran may be certified as in compliance with the country’s nuclear deal with the P5+1 states. If it is in compliance, Iranian oil may hit international markets again, putting another wave of pressure on prices and further saturating an already oversupplied market.

Recent uncertainty about China’s economy is also a troublesome development for producers. “Slowing investment and construction in China, the world’s biggest energy user, is “sending an enormous deflationary impetus through to the world, and that is a significant part of what’s happening in this oil-price collapse,” Adair Turner, chairman of the Institute for New Economic Thinking told Bloomberg.