A more optimistic Saudi private sector reacting to the start of the vaccine rollout in the Kingdom is is being credited for positive data seen for Saudi Arabia’s economy, Jadwa Investment says in its latest Charbook for the month of January 2021.

Saudi Arabia’s non-oil PMI saw a significant monthly rise in November, the latest data available and reported in this Chartbook, with the index hitting its highest reading since January 2020. The Kingdom’s consumer spending also surged by almost 33 percent year-on-year in the same month.

The net monthly change to government accounts with SAMA was marginally up by almost SR2 billion month-on-

month ($533 million) in November. Meanwhile, SAMA FX reserves rose by $10.3 billion month-on-month in November, to stand at $457 billion. A breakdown of FX reserves shows that there were monthly increases in SAMA’s foreign securities and bank deposits during the month, by $4.2 billion and $6 billion, respectively, Jadwa said.

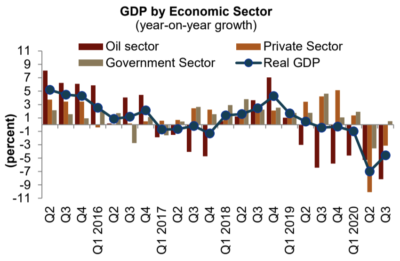

Data on Q3 2020 real GDP showed that the economy contracted by 4.6 percent, year-on-year.

The broad measure of money supply (M3) rose by 11.6 percent year-on-year in November, and by 1.5 percent month-on-month. Growth in demand deposits continued, and total bank claims rose by 15 percent in November, according to Jadwa.

The positive recent trend in data comes on the back of a tough year overall for the Kingdom’s economy. The global pandemic and significant drop in oil prices earlier in the year weighed on nearly all sectors. Shutdowns and other government measures, which were largely successful in curbing the virus’ spread in the Kingdom, nevertheless came at a high cost to the Saudi economy. Data on Q3 2020 real GDP for Saudi Arabia showed that the economy contracted by 4.6 percent, year-on-year. The oil sector declined by 8.2 percent (40 percent share of GDP), while non-oil GDP declined by 2.1 percent.

Meanwhile, oil continued to show signs of recovery and market strength. According to Jadwa, major oil benchmarks saw sizable rises during December, with Brent rising 19 percent and WTI rising 15 percent month-on-month.

“Looking ahead, we expect a recovery in oil demand to help push Brent to $55 pb in full year 2021,” Jadwa says.

[Click here to read the full report from Jadwa Investment] [Arabic]