An exhaustive report in the Financial Times (a paywalled source) by reporter Anjli Raval sheds light on Saudi thinking and strategy during the fall in the price of oil from highs in the summer of 2014.

The report, which requires subscription to read, follows Saudi policy and events in oil markets, month to month, starting in June of last year.

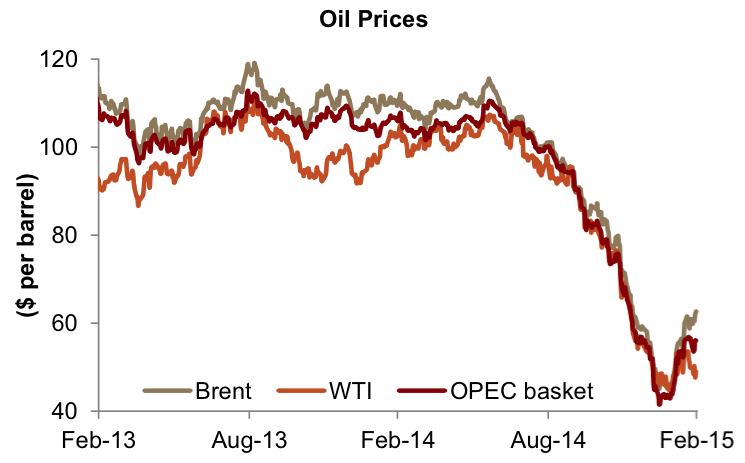

A report details the strategy of Saudi officials during the fall in the price of oil from June 2014-onward.

The shift in Saudi oil policy to refuse to cut production despite oversupply in the market and weak demand was “crystallised between June and October” and “had an immediate impact” from government budgets to oil company investment plans, Raval writes. “Some suspected it was rooted in geopolitics: one theory held that the Saudis, acting under US influence, deliberately sought to undermine rivals Russia and Iran. But a close examination of Saudi actions suggests an unexpected series of global political events and — crucially — a misreading of the market were the driving forces behind Riyadh’s gamble.”

The reporter describes a pivotal moment in October 7th, 2014, when a critical Saudi oil official, Nasser al-Dossary, who reportedly had the ear of Ali al Naimi and might know Saudi Arabia’s game plan as the price of oil continued to fall, indicated at a high-level energy sector dinner that Saudi Arabia may not cut production to stop the fall in the price of oil.

“What makes you think we’re going to cut?” al-Dossary said, which the reporter described as “throwaway remark” that nevertheless “reverberated across markets…It was the first sign that Saudi Arabia would not come to the oil market’s rescue, shattering long-held assumptions about the kingdom’s oil policy.

Click here to read Raval’s report, “The Big Drop: Riyadh’s Oil Gamble.”