A global surge in Coronavirus cases and resulting lockdowns in late 2020 will cause oil demand to rebound more slowly in 2021 than previously thought, OPEC said on Wednesday.

The surge in Coronavirus cases will hamper efforts by OPEC and its allies to support the market, Reuters reports.

A second wave of cases is sweeping across Europe, with many E.U. nations now under lockdown restrictions to curb the virus’ spread. The U.K. has also entered a lockdown period.

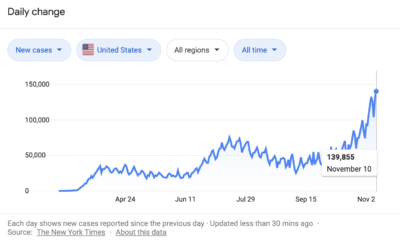

New Coronavirus cases are soaring in the United States.

In the United States, new cases are shattering records on a near-daily basis, with new cases reaching nearly 140,000 on December 10th alone.

According to OPEC’s figures released in its latest monthly report, demand will rise by 6.25 million bpd in 2021 to 96.26 million bpd. The growth forecast is 300,000 bpd less than expected a month ago.

The weakening demand recovery could support the case for the OPEC+ group of producers to delay a scheduled increase in oil output next year, currently being mulled by group leaders.

“The oil demand recovery will be severely hampered and sluggishness in transportation and industrial fuel demand is now assumed to last until mid-2021,” OPEC said in the report.

As Bloomberg notes, while the cartel is actually pumping 2.1 million bpd less than the amount required, “the revisions mean it’s not whittling away surplus oil stockpiles as quickly as previously estimated.”