Following the death of Saudi Arabia’s King Abdullah, it is important for companies to be prepared to answer questions from the corporate office regarding how royal succession impacts Saudi Arabia’s trajectory. New Saudi King Salman’s ascension to the throne, and the appointment of Crown Prince Muqrin, represents continuity from King Abdullah’s reign. Salman is unlikely to alter Saudi Arabia’s economic or investment paths, because of critical business ties to Asia, Europe, and the US.

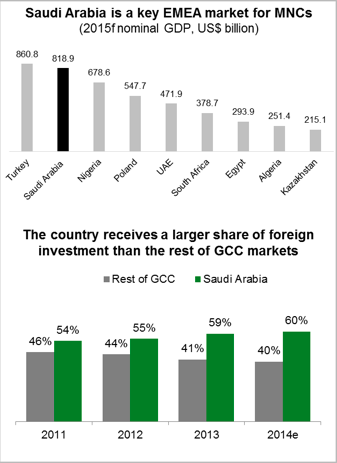

Given the prominence of the Saudi market in MNC portfolios, it will be critical to determine what the royal succession means for your business. In the past, FSG conducted a survey which revealed that our clients count on Saudi Arabia to deliver sales growth rates that are more than double the overall average in the Middle East and Africa region. In addition, Saudi Arabia receives a majority of FDI directed to the GCC, indicating a heavy reliance on the Saudi market among foreign investors.

To understand the king’s importance to business and investment, consider how the king’s role has evolved during the past several decades. The king of Saudi Arabia is essentially the CEO of one of the largest corporations in the world.

Four ways the king manages Saudi Arabia Inc.:

*Messaging to the board: The Saudi state’s legitimacy is built on support from religious conservatives, and the king must ensure they are satisfied with the direction of the country

*Keeping employees motivated: The king manages royal family rivalries by appointing new princes to positions of importance. Princes are motivated to remain loyal based on the prospect of increasing power that is laid out by this policy. The king also allocates generous allowances to more than 25,000 royal family members in exchange for support

*Setting the corporate vision / strategy: King Abdullah’s cautious reform agenda, which King Salman is expected to uphold, is slowly improving the investment climate and aims to promote sustainable growth. While the king cannot control all of the implementation, his vision plays a key role in the shaping the direction of the kingdom

*Portfolio Management: As part of the king’s power to set a strategic agenda, he sets the tone for which sectors and sub-regions benefit the most from public spending.

Just as corporate entities are vulnerable to a lack of clear succession planning, so is Saudi Arabia Inc. However, King Abdullah did much to alleviate these concerns in recent years, positioning young princes in key ministerial and gubernatorial posts, and ensuring the princes that are next in the line roughly share his vision for the country. Still, doubts will likely persist until Saudi Arabia is able to successfully move to the next generation of leaders. Today’s appointment of Prince Mohammed bin Nayef as Deputy Crown Prince will give him an edge to be the first of his generation to ascend to the throne.

Companies can strengthen continuity in their Saudi business amid an uncertain future through four actions:

*Establish and maintain government contacts on multiple levels: ministerial, regional, and municipal. This will promote cohesive relationships during the current and future leadership transitions.

*Consider extending receivables for key customers and buying long-dated oil futures if you are concerned about a sustained disruption to the business landscape. While a disruption appears to be unlikely right now, local dynamics should be monitored on an ongoing basis in the upcoming months.

*Do not alter or reduce investment plans in Saudi Arabia, particularly in social sectors such as education, healthcare, and housing or quality-of-life sectors such as e-government, parks, public transportation, and rail.

*Communicate to corporate that you have a plan for this royal succession, and future occurrences, to ensure that you control the conversation on resources for the market.

Matthew Spivack is Frontier Strategy Group‘s head of research for the Middle East and North Africa. Prior to Frontier Strategy Group, Matthew worked for the National Democratic Institute on programs involving local government officials and journalists in Gulf Cooperation Council countries as well as anti-corruption initiatives, parliament, and political parties in Yemen. He also spent two years as a paralegal at the U.S. Department of Justice where he was the Victim Witness Coordinator for the Enron Task Force and worked on the largest FCPA case in U.S. history. Matthew has a master’s degree in Middle East Studies and Conflict and Conflict Resolution from George Washington University’s Elliott School of International Affairs.