A recently-released report from Jadwa Investment finds “a fair level of progress on most areas” in the Kingdom’s important Financial Sector Development program (FSDP), encouraging news for the diversification of Saudi Arabia’s economy and modernization of its financial sector.

The Financial Sector Development Program (FSDP).

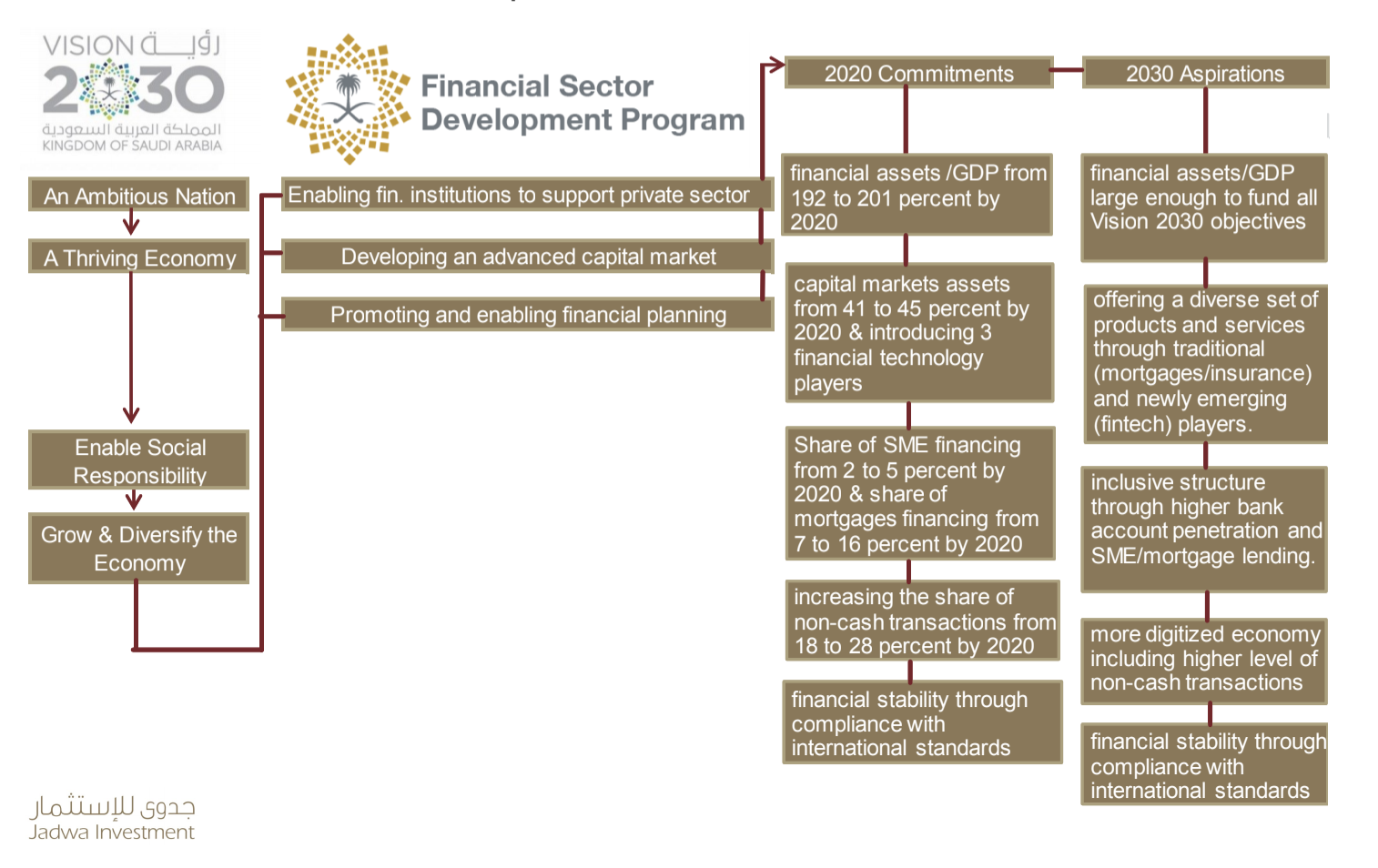

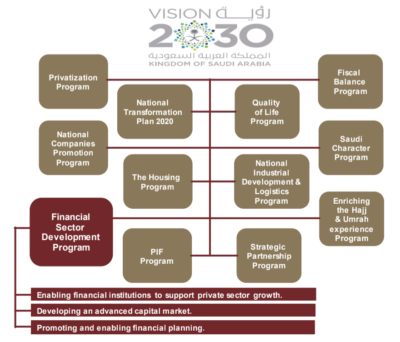

The FSDP, one of the Kingdom’s Vision 2030 ‘Vision Realization Programs’ (VRPs), aims to develop a diversified and effective financial sector to support the development of the national economy, diversify its sources of income, and stimulate savings, finance and investment. The FSDP “will achieve this ambition by enabling financial institutions to support private sector growth, ensuring the formation of an advanced capital market, and promoting and enabling financial planning, without contradicting the strategic objectives of maintaining the stability and solidity of the financial sector,” Saudi Arabia says.

The FSDP is of critical importance to the Kingdom of Saudi Arabia’s Vision 2030 economic and social reform drive because the success of the other 11 VRPs are wholly dependent on it. ““Ultimately, due to the scale of funding required for various projects and investments to be realized under the Vision, a fully developed, modern and inclusive financial sector is the only way in which the economic aspirations to increase the size of the Saudi economy threefold, by 2030, will be achieved,” Jadwa said last year.”

Over the last year, there has been “a fair level of progress on most areas covered by the FSDP,” Jadwa writes. “In particular, visible progress has been made in the development of the SMEs financing ecosystem, the insurance sector, capital markets and housing,” Jadwa Investment said in a recently-released research note. “One of the most notable developments has been the inclusion of the Saudi Stock Exchange (Tadawul) into both the MSCI Emerging Market (EM) and FTSE EM indices, which has resulted in inflows totaling $21 billion (SR79 billion) so far this year.”

“Additionally, a number of changes have been made to improve the SMEs financing ecosystem, and indeed the overall commercial environment in the Kingdom. One of the most notable changes in this respect has been the introduction of a bankruptcy law. Meanwhile, in the Fintech sector, progress has been made through the launch of a sandbox regulatory environment, which is designed to help improve the level of understanding and impact of new technologies in the financial services and products market in the Kingdom.

With progress made on these fronts, Saudi Arabia still has work to do in promoting and enabling financial planning, a pillar of the FSDP, Jadwa said.

“[W]ith the latest Income and Household Survey showing that household savings have declined, measurable progress is yet to be made in rolling out initiatives set out under ‘promoting and enabling financial planning’ pillar of the FSDP, which aims to support a national savings strategy.”

[Click here to read the full report from Jadwa Investment] [Arabic]