Saudi Arabia’s central bank, the Saudi Arabian Monetary Authority (SAMA), is introducing an open banking policy to advance digital innovation in the financial services sector, the body announced this week.

Open banking facilitates the connections and permissions between users’ banking data and third-party financial platforms. It enables the secure sharing of financial and other data to enable seamless digital payments and money transfers. Open Banking also represents an opportunity for stakeholders to leverage on the data associated with financial transactions to imagine and access new ways of managing money. Customers will benefit from better financial products and services, ranging from bringing all accounts into a single dashboard to creating smoother journeys into daily banking activities. Data are securely shared, and customers have a choice to consent to give access to third-party providers providing explicit and informed consent.

SAMA’s Open Banking “supports the innovation in the Kingdom’s financial sector, prudently enabling market players in the journey towards new paradigms,” the organization said,.

In a document shared online titled, “Open Banking Policy,” Saudi authorities at SAMA show how the organization is “devoting diligent efforts to support the Kingdom’s economic growth and safeguarding financial and monetary stability. In line with these efforts, SAMA is pleased to announce that it is developing its Open Banking initiative and services through further collaboration with the market.”

“This initiative is in line with strategic priorities set in the Saudi Vision 2030 and in the Financial Sector Development Program (FSDP). These priorities include developing a digital economy, enabling Financial Intermediaries to support private sector growth through open financial services to new types of players. SAMA supports the innovation in the Kingdom’s financial sector, prudently enabling market players in the journey towards new paradigms.”

“Open banking will lead to direct innovation by enhancing opportunities to develop new products and services — either ‘in-house’ or in collaboration with third parties – to increase financial players’ value proposition and create additional revenue streams,” SAMA said.

The policy is used across the world in the UK, Europe, Singapore, and more. The U.S. is off to a slower start with open banking when compared to the U.K. and others.

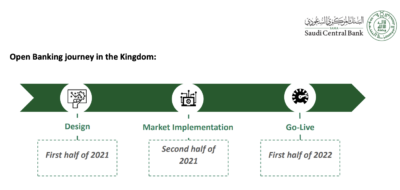

SAMA plans to go live with Open Banking during the first half of 2022. In order to meet this challenging objective, SAMA has already analyzed the adoption of Open Banking globally and collected the local financial market participants’ feedback on Open Banking, the organization says. SAMA is currently assessing the potential impact Open Banking may have on the Saudi Financial Sector and is working to identify the most suitable approach to adopt Open Banking in the Kingdom.

[Click here to read the document from the Saudi Arabian Monetary Agency]