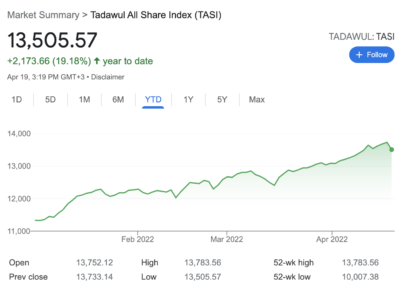

Saudi Arabia’s benchmark index, the Tadawul All Share Index (TASI), is the sixth best performing globally “and gains may not be over yet,” analysts and fund managers believe, according to Bloomberg.

The TASI is up 22% this year in dollar terms. With many banks and energy stocks listed, the gauge has been supported by soaring oil prices and rising interest rates, according to the report.

The recent gains were pared back today by 1%, as investors moved to secure their gains after a series of increases.

Soaring oil prices and rising interest rates are helping Saudi stocks continue a hot streak.

Optimism for the Saudi economy in 2022 continues to grow on the back of higher oil prices and a Kingdom well-positioned to grow in the post-pandemic year.

Saudi Arabia’s stock exchange has so far seen 16 listings in 2022 and over 70 applications are pending, said Mohammed Al-Rumaih, the CEO of the bourse, according to a report in Arab News. Three listings are awaiting approval from the market regulator.

Saudi Arabia, the world’s top crude oil exporter, saw its crude exports rise in February to the highest level since the April 2020 month-long price war with OPEC+ ally Russia. Oil prices leapt 50% last year as demand recovered from the Covid-19 pandemic, and then surged above $100 a barrel after the Russian invasion of Ukraine.

The Kingdom may invest up to $50 billion this year alone to boost oil capacity.