Saudi Arabia’s stock market has continued a tumultuous start to the new year, with the Kingdom’s benchmark index falling another 4.8 percent on Thursday to a four-year low. According to the Financial Times, the drop this year has totaled 10.6 percent, and leaves it 44 per cent weaker than its post financial crisis peak in 2014.

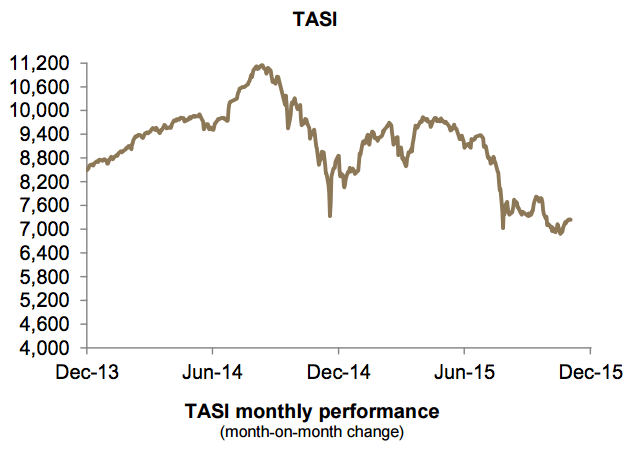

The TASI declined by 4.6 percent during December of 2015.

The Tadawul was not alone in its losses. Stocks in the U.S. and Europe sank after trading was halted in China for the second time this week. Markets had plummeted in Asia over concerns about China’s currency, the New York Times reports.

Low oil prices, recently announced subsidy cuts, and regional turmoil are putting downward pressure on Saudi Arabia’s market. Oil prices have slumped to an 11-year low, and despite an escalation in heated rhetoric between Saudi and Iran officials and a severing of ties, oil prices have not spiked upward in response.

“December’s decline reversed the gains of the previous month and resulted in the TASI being one of the worst performers compared to major regional and global indices in December,” Riyadh-based Jadwa Investment said in its January 2016 chartbook.

“We expect the TASI to stabilize around current levels in early 2016.”