The total amount invested by Saudi traders in the U.S. stock market through companies licensed by the Capital Market Authority (CMA) surged 162 percent, year-on-year, to SR77.4 billion ($20.64 billion) in the first quarter, Zawya reports, citing data compiled by financial website Argaam.

“While the first three months of the year reported a strong year-on-year increase, the last three quarters of 2020 saw such massive growth in US trades that the first quarter of 2021 was still 21 percent lower than the final quarter of 2020, according to data compiled by financial website Argaam,” Zawya reports.

The TASI has performed well in 2021.

Indeed, 2020 saw a massive surge of Saudi investments in the U.S. stock market in general. Overall, in 2020 the total amount traded by Saudis in the US market increased 606 percent year-on-year to SR323.365 billion ($86.23 billion).

The Dow Jones Industrial Average closed the year up 16.3 percent and the Nasdaq gained 43.6 percent, its highest since 2009.

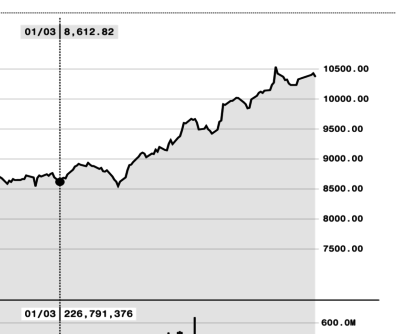

For local investors, the Tadawul has also seen gains in 2021. The index closed on January 3rd above 8612.12., and reached 10,372.54 on May 19th.