In June, Bank of America forecasted that oil may reach $100 by sometime in 2022 on surging demand and a rebounding global economy. At the time, the Charlotte, NC-based bank was the most bullish of the major forecasters for a return to triple digits by 2022.

Now, a confluence of forces is stoking the price of oil ever higher as analysts and economists eye the potential for crude to reach $100 soon — and possibly before next year.

Riyadh-based Jadwa Investment, in a recent research note on oil, said there is a “strong possibility” that oil prices could trend higher in the near term “if gas-to-liquid substitution accelerates during the winter months. This combined with any unplanned outages in oil output (from Libya, for example) could well push oil prices towards $100 per barrel.”

The rally in oil prices has mainly been a result of demand, Jadwa Investment said.

Other externalities could push the price up toward $100, like a colder winter than expected.

Marco Dunand, the chief executive officer of commodities trader Mercuria Energy Group Ltd., told Bloomberg that it’s “possible” that oil will hit $100 a barrel this winter, “but $80 to $90 is the expected range,” he said. Citigroup last week hiked its Brent oil outlook to $85 a barrel for the fourth quarter and said crude will likely hit $90 at times, according to CNN.

Russia’s Vladamir Putin, leader of one of the world’s biggest oil-producing nations which is now part of the OPEC+ group of producing nations, told CNBC’s Hadley Gamble that $100 oil “is quite possible.”

But such a rise is likely to push the OPEC+ group of oil producing nations, including Russia, to boost output to meet demand and tamp down prices, Putin said, a sentiment echoed by Jadwa Investment and others.

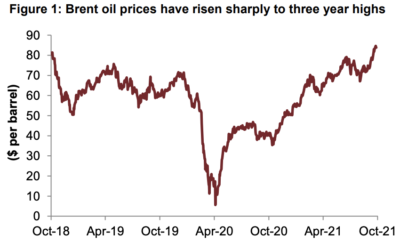

Brent oil prices averaged $74 per barrel during Q3 2021, up 7 percent quarter-on-quarter and 71 percent over the same period last year, according to Jadwa. Brent oil’s rally has continued into Q4, with the benchmark rising a further 10 percent over September levels. According to OPEC, oil demand rose by 3 percent quarter-on-quarter in Q3, to 98.3 million barrels per day (mbpd), as the continued roll-out of vaccines across the world eased restrictions in mobility and helped lift transportation fuel (jet fuel and gasoline) closer towards pre-pandemic levels, Jadwa said.

“It’s difficult to think the psychology of the market can be anything but bullish ahead of the winter,” he said. “We have a bullish view on commodities and on energy,” Dunand told Bloomberg.

Jadwa Investment says that oil’s rally is likely to face headwinds going into 2022.

“With OPEC actually forecasting a quarterly decline in global oil demand (by 2 percent) in Q1 2022 (prior to hitting all-time highs by Q4 2022), this further diminishes the possibility of oil prices being sustained at $100 per barrel (if they hit this level), beyond the near term,” Jadwa said.

“As such, while we acknowledge that there is an upside risk to our full year 2021 Brent oil forecast of $67 per barrel, we have kept our full year 2022 Brent oil forecast unchanged at 65 pb,” Jadwa said, “for now.”

[More from Jadwa Investment’s research note on oil] [Arabic]